One of the most pressing issues in the multifamily real estate market has been the rising cost of rents and the subsequent affordability concerns for many households. This trend is not only affecting market dynamics but also shaping the socio-economic landscape of urban areas.

The Impact on Low- and Moderate- Income Households Rising rents have become a significant burden, particularly for low- and moderate-income households. These groups are disproportionately affected, struggling to secure affordable housing options. According to Multi-Housing News, the steady increase in rents is making it increasingly difficult for these households to find and maintain housing that fits within their budgets.

Despite these challenges, occupancy rates in multifamily properties remain solid. The large number of units delivered in recent years are being absorbed at a steady pace, indicating a sustained demand for rental housing. However, this demand is not necessarily reflective of affordability but rather the lack of alternative housing options for many renters.

Economic and Policy Drivers Several economic factors are driving the rise in rents. High interest rates, intended to curb inflation, have had a ripple effect on the real estate market. These rates have increased the cost of financing for new construction, slowing down the development of new multifamily projects. This slowdown in new supply exacerbates the affordability issue as the demand continues to outpace the supply of rental units.

Market Reactions and Investor Strategies In response to these challenges, investors and developers are adopting new strategies. Some are focusing on acquiring properties below replacement costs, a trend highlighted by JLL Capital Markets. This approach allows investors to purchase existing assets at a discount, potentially offering more affordable rental rates compared to new constructions. Additionally, there is a growing emphasis on innovative solutions to address affordability. These include modular construction techniques and the repurposing of existing structures to create more affordable housing units. While these measures can help, they are not sufficient to fully mitigate the rising cost of rents in many urban areas.

The Role of Government and Community Initiatives Addressing affordability concerns requires a concerted effort from both the private and public sectors. Government policies that support affordable housing development, such as tax incentives and subsidies, are crucial. Moreover, community initiatives that focus on creating inclusive housing policies can help ensure that low- and moderate-income households are not left behind.

A great example of these tax programs is the Public Facility Corporation (PFC) or Housing Finance Corporations (HFC), which often allow for up to a 100% tax abatement in exchange for a certain amount of units being allocated to affordable housing, usually 50%+ of the units.

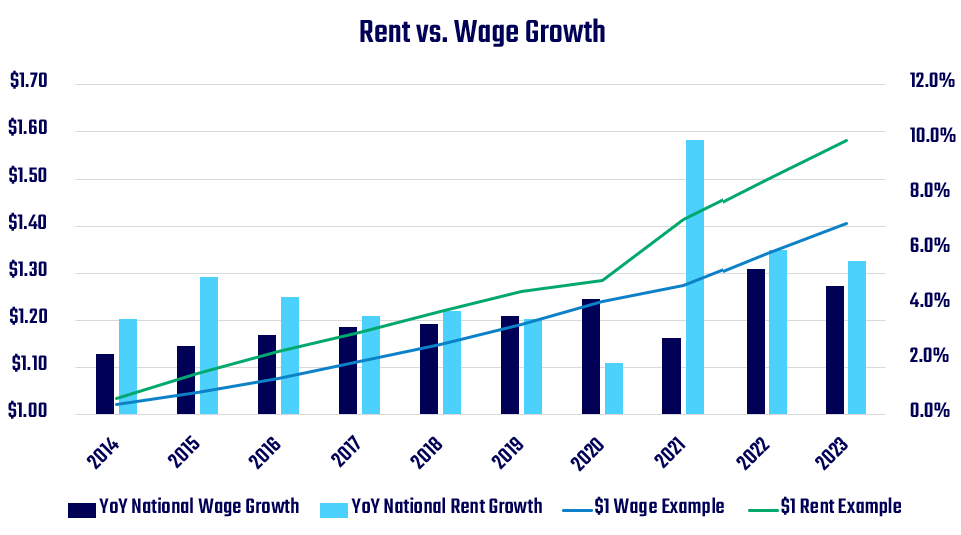

The graph above provides a compelling depiction of the increasing gap that continues to grow between wages and rents.

While $1.00 of income in 2013 would be equivalent to $1.41 today, $1.00 of rent would be equivalent to $1.58 today.

Conclusion

The issue of rising rents and affordability is a complex challenge that demands innovative solutions and collaborative efforts. As the multifamily real estate market continues to evolve, stakeholders must prioritize affordability to ensure that all households have access to safe and affordable housing. As stewards for both our investors and residents, Club Capital is actively searching for solutions to provide affordable housing options in a manner that benefits all parties.

As always, making money is transactional; building wealth is foundational. Break the cycle by investing smartly and focusing on long-term strategies that offer stability and growth for all.

Interested in learning more about how Club Capital is acting as stewards to both our investors through new affordable housing investment opportunities? Sign up for our newsletter below or schedule a meeting with our team.