PREFERRED EQUITY IN TODAY’S INVESTMENT LANDSCAPE

Today’s dynamic landscape in commercial real estate investments has opened the door for a significant opportunity for investors. “What might this be?” you may ask. Well the answer is Preferred Equity. With its unique blend of debt-like features, Preferred Equity holds a priority position to Common Equity as it pertains to distribution and repayment. Preferred Equity provides greater investor protection and income potential that can match and often exceed the returns achieved by Common Equity in current market conditions. This is a flight to safety for investors with double-digit returns.

FOR EXAMPLE

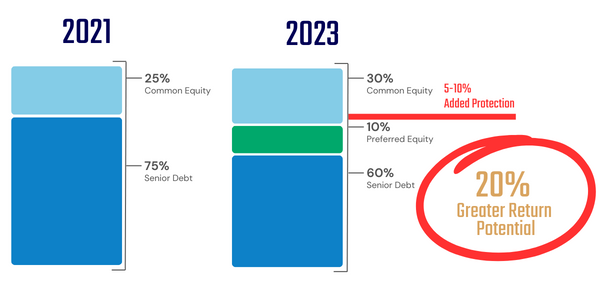

- In a standard real estate deal in 2021, lenders would contribute up to 75% of the total project capitalization and secure the senior position rights for repayment.

- Next, the Preferred Equity investor might hold up to 10% of the capital investment, positioning them next for repayment.

- The remaining 25% of the required capital comes from Common Equity.

FAST FORWARD TO TODAY

- In the current market, 2023/2024, lenders are more inclined to contribute 60% of the total project capitalization to secure senior positions for repayment rights.

- What exactly does this mean? Preferred Equity has an additional 5-10% of the Common Equity capital behind their investment, adding extra safety for the Preferred Equity investors.

HERE IS WHERE IT BECOMES ATTRACTIVE FOR THE INVESTOR

In today’s market, the rate of return for Preferred Equity investment is a market 12% while occupying 10% of the capital stack. In the meantime, Common Equity investments today often only pencil out around a 10% return while occupying roughly 30% of the capital stack. Translation: Preferred Equity can potentially generate a 20% greater return than Common Equity, amplified with the additional 5-10% protection from Common Equity needed due to the decrease in loan proceeds.

If Preferred Equity can produce about the same or even higher returns as we would expect from a Common Equity position, why wouldn’t we take the same or higher return with a more protected position?

Want to learn why Preferred Equity is our choice for today’s market? Sign up for our newsletter below or schedule a meeting with our team.