Urbanization has long been synonymous with the growth and development of major metropolitan areas. However, as these primary markets become increasingly saturated and expensive, investors are turning their attention to secondary markets, uncovering a wealth of untapped opportunities. This shift is not just a trend, but a strategic move driven by evolving urbanization patterns and economic dynamics.

WHY SECONDARY MARKETS?

The Rising cost of Living As the cost of living and doing business in primary markets skyrockets, both residents and companies are seeking more affordable alternatives. This migration creates a ripple effect, stimulating economic growth and increasing demand for commercial real estate in these areas.

Quality of Life Secondary markets tend to have lower congestion, better housing affordability, and a more relaxed lifestyle compared to their larger counterparts. This appeal attracts a diverse population, including young professionals, families, and retirees, all of whom contribute to a vibrant and dynamic community. As these populations grow, so does the need for commercial spaces such as retail, office, and multifamily properties.

Tech and the Work From Home Trend Technological advancements also play a crucial role in the rise of secondary markets. Remote work, accelerated by the COVID-19 pandemic, has decentralized the workforce, allowing companies to operate from virtually anywhere. This flexibility reduces the necessity for businesses to maintain a presence in expensive primary markets, making secondary markets a viable option for corporate expansion and relocation.

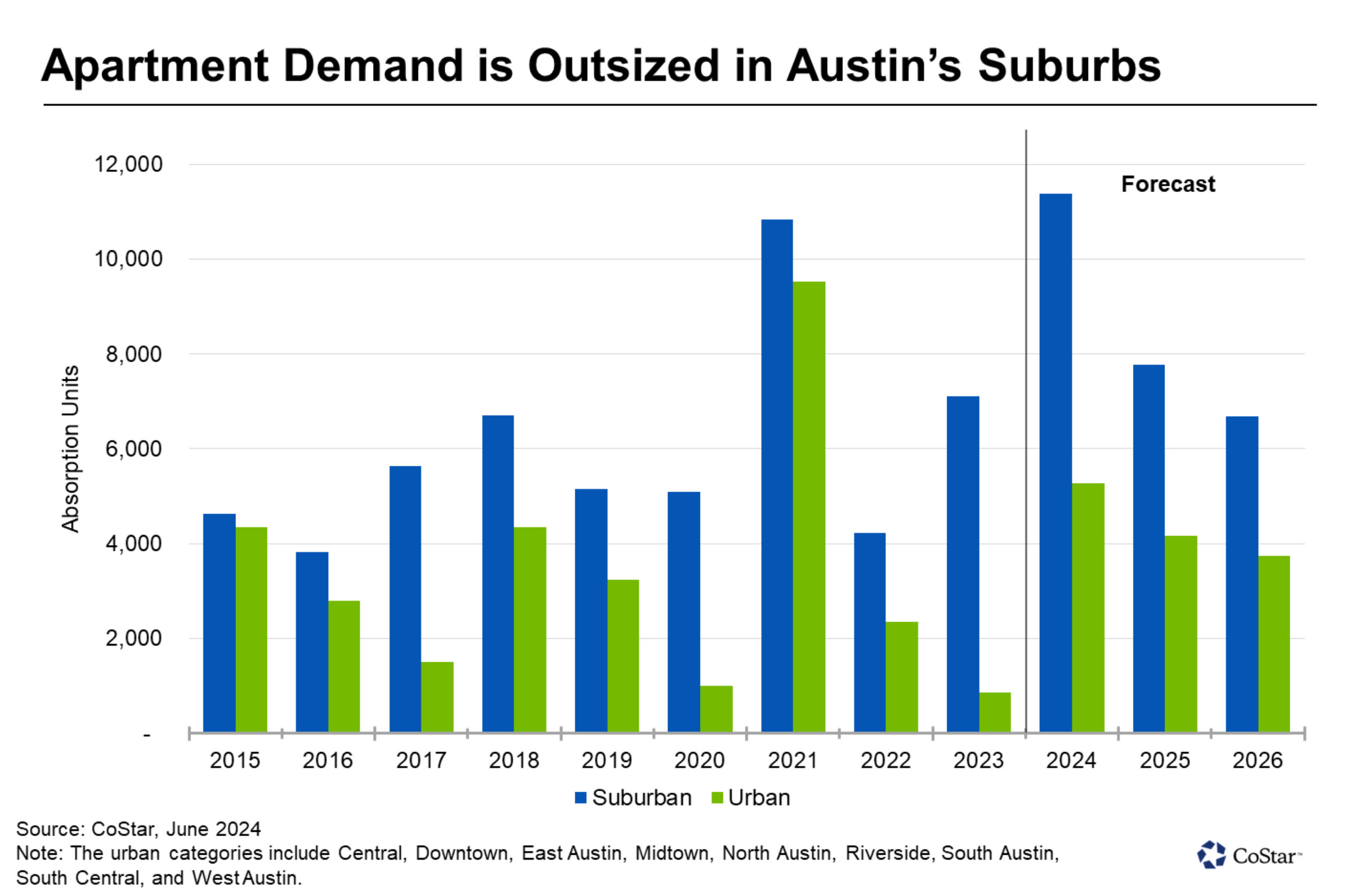

Case Study: Austin and it’s Suburbs Households moving to the suburbs looking for less expensive housing and ample job options account for a significant amount of Austin’s population growth, with renters increasingly settling in the suburbs of Georgetown, Round Rock and Kyle, all within a roughly 30-minute drive of Austin’s central business district.

LEVERAGING DATA TO CAPITALIZE

As we navigate the future of urbanization, it’s crucial to stay informed and adaptable. Our approach at Club Capital involves continuous education and strategic execution:

We look for key indicators such as population growth, infrastructure development, and economic diversification to identify high-potential markets early. Cities investing in technology, healthcare, and education are often at the forefront of sustainable growth, making them prime targets for investment.

In the evolving landscape of commercial real estate, secondary markets present a golden opportunity. By positioning ourselves in these emerging urban centers, we can capitalize on the ripple effects of economic growth and increased demand for commercial spaces. This strategic move aligns with our core values of building long-term wealth and making informed, impactful investment decisions.

Join us in breaking the cycle and embarking on this exciting journey. Stay connected with Club Capital for the latest insights and opportunities in the world of real estate investment. Together, we can navigate the future of urbanization and build a legacy of success.

As always, the journey to financial success in real estate is not just about making money—it’s about building a robust portfolio that can withstand the test of time and market cycles.

Interested in learning more about why Preferred Equity is our choice for today’s commercial real estate market? Sign up for our newsletter below or schedule a meeting with our team.