Lessons from 2008: Follow the Data

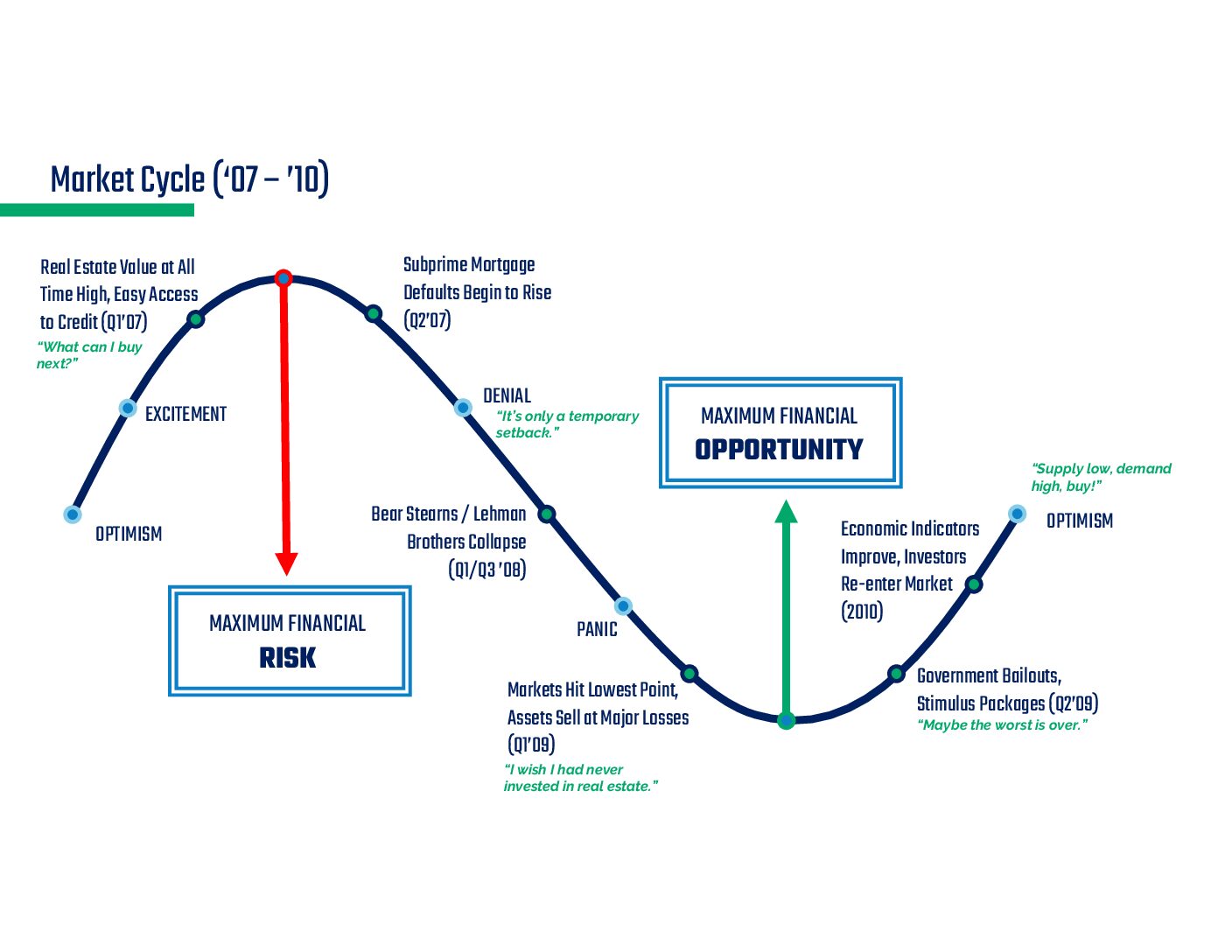

For most of you reading this blog, the 2008 economic collapse is a vivid memory. As highlighted in the movie The Big Short, it was a painful period for almost everyone, except for a few who analyzed the data and capitalized in a big way. At the time, my investing career was six years in the alternative investment space, primarily Commercial Real Estate. However, I lacked the experience to fully understand the data and make long-term investment decisions based on facts rather than emotions. Although we survived and eventually thrived, we could have avoided much of the heartache and gained much more wealth.

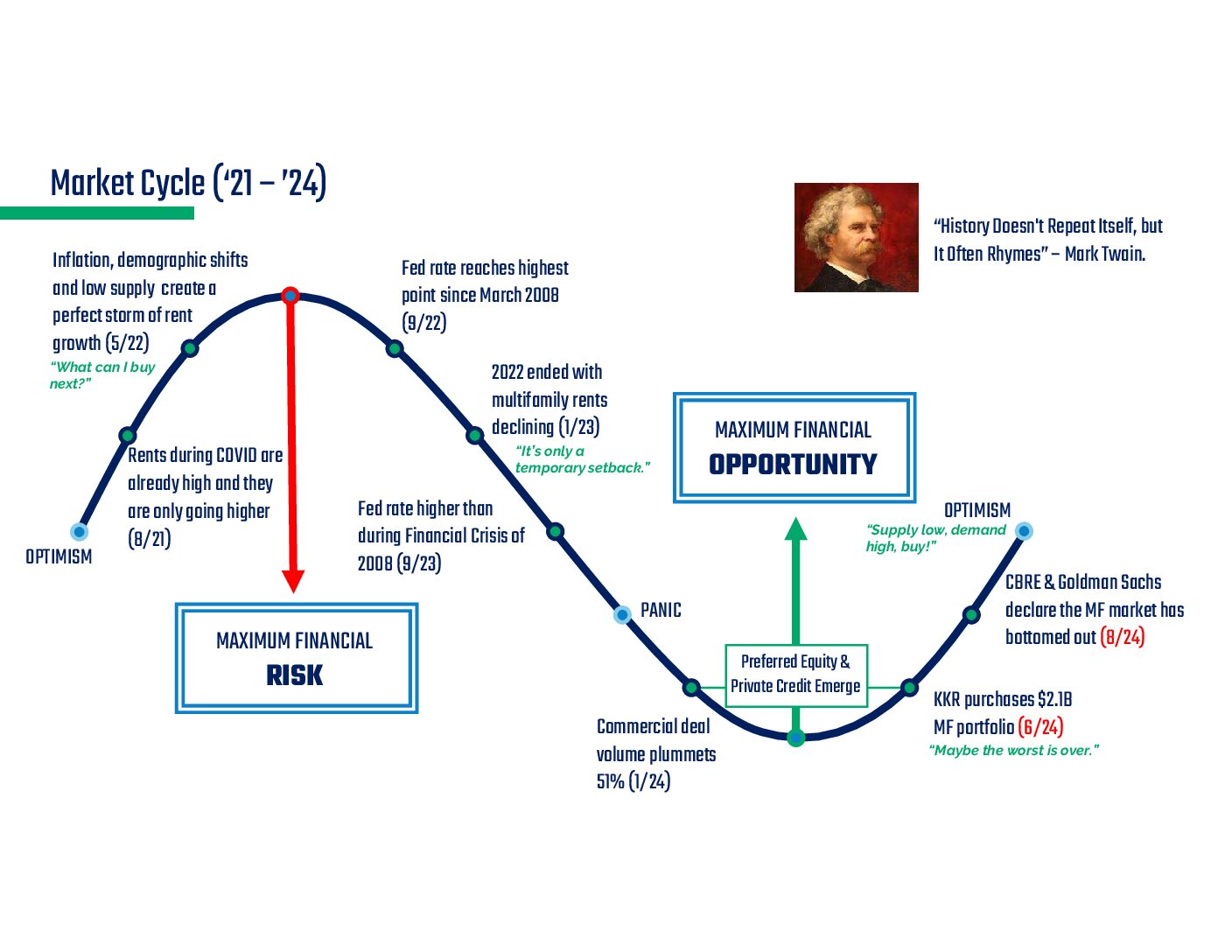

To illustrate what has happened to the data decisions vs the emotional decisions, see the parallels in the graph for investors in 2008-2010 and compare that to 2021-to today. You can probably place yourself on the chart, and I know the institutional money knows precisely where it falls on the graph.

The Market Signals a Bottom: Time to Act

The market is signaling a bottom, and the data is clear. Institutional money is starting to reenter the market. Strategic or portfolio assets are receiving multiple offers at or above the asking price. The numbers say now is the time to reenter the market, and we plan to do just that.

The Multifamily Sector: Poised for a Promising Recovery in 2025 and 2026

The multifamily sector of commercial real estate (CRE) has faced significant challenges over the past few years. However, recent data and key indicators suggest that the market has hit bottom and is now positioned for a robust recovery in 2025 and 2026. This optimistic outlook is particularly relevant for the Sunbelt region, where demographic trends and economic factors are aligning to create a fertile ground for growth.

Interest Rates and Economic Conditions: The Federal Reserve’s aggressive interest rate hikes over the past two years have undoubtedly impacted the multifamily sector. Higher borrowing costs slowed down new developments and put pressure on existing properties. However, there is light at the end of the tunnel. Analysts from Goldman Sachs predict that interest rates will begin to stabilize and potentially decrease in late 2024 and into 20251. This anticipated reduction in interest rates will lower the cost of capital, making it more feasible for developers to finance new projects and for investors to acquire properties.

Looking ahead to 2026, projections from various financial institutions, including the Federal Reserve and major banks, suggest that interest rates will continue to stabilize. The consensus is that rates will hover around 3-4%, which is significantly lower than the peak rates seen in 20232. This stabilization will provide a more predictable environment for investors and developers, encouraging further investment in the multifamily sector.

Supply and Demand Dynamics: The Sunbelt region, encompassing states like Texas, Florida, Georgia, and North Carolina, has been a focal point for multifamily investments. Despite recent challenges, the long-term demand drivers remain strong. The region continues to attract a significant influx of residents due to its affordable cost of living, favorable climate, and job opportunities3. This population growth is a critical factor driving demand for multifamily housing.

On the supply side, the pace of new construction has shown a significant slowdown. After reaching a peak in late 2023, the number of new units coming online is projected to decrease by about 10% in 2024 and as much as 30% by 2026. This reduction in new supply, coupled with steady demand, will help to balance the market and support rent growth in late 2025 and 2026.

Key Indicators from Industry Leaders: Several key indicators from industry leaders reinforce the positive outlook for the multifamily sector. CBRE reports that vacancy rates have plateaued and are beginning to show signs of improvement. This stabilization is a crucial indicator that the market is finding its footing.

Moreover, KKR’s recent $2.1 billion acquisition of a multifamily portfolio concentrated in the Sunbelt region underscores the confidence that major investors have in the market’s recovery. This portfolio includes high-quality, Class A assets in growing metropolitan areas, highlighting the strategic importance of the Sunbelt for future growth.

Insights from CoStar and RealPage: Data from CoStar indicates that while the Sunbelt multifamily demand underperformed over the past two years, projections for 2024 and 2025 show a rise in apartment demand. For example, CoStar’s analysis reveals that cities like Austin and Atlanta are expected to see a 5-7% increase in rental demand by mid-2025. This increase, although not yet matching supply, is a positive sign of recovery.

RealPage also highlights that nearly 60% of the nation’s property sales volume was focused in the Sunbelt as of the third quarter of 2021. This trend underscores the region’s attractiveness to investors and its potential for growth. Specific markets like Dallas and Charlotte have seen significant investment activity, with RealPage noting a 15% year-over-year increase in transaction volumes in these cities.

Additional Insights from JLL and Marcus & Millichap: JLL’s recent reports highlight the resilience of the multifamily sector, particularly in the Sunbelt region. JLL notes that the Sunbelt continues to attract significant investment due to its strong economic fundamentals and population growth. The firm also emphasizes that the region’s job growth and business-friendly environment are key drivers of multifamily demand.

Marcus & Millichap’s 2024 National Multifamily Investment Forecast provides further evidence of the sector’s recovery. The report highlights that the number of occupied apartments nationwide surged by nearly 104,000 rentals from January through March 2024, the strongest first-quarter net absorption on record. This robust demand, coupled with a record level of new supply, indicates a dynamic and evolving market.

Patience and Data-Driven Optimism

While the road to recovery may not be immediate, patience and data-driven strategies will be key to navigating this transition. Investors and developers who remain focused on the long-term fundamentals will be well-positioned to capitalize on the market’s resurgence. The combination of stabilizing interest rates, balanced supply and demand, and strategic investments by industry leaders all point to a promising future for the multifamily sector.

Conclusion

The multifamily sector in the Sunbelt region, particularly in Texas and Florida, is poised for sustained growth. With projected interest rates stabilizing and a continued focus on amenities, the multifamily sector offers promising opportunities for investors. By following the data and acting strategically, investors can capitalize on this rebound and achieve significant returns.

As Mark Twain famously said, “History doesn’t repeat itself, but it often rhymes.” The lessons from the past can guide us to make informed and strategic decisions today.

“Making money is transactional; building wealth is foundational.” – Darin Davis

Interested in learning more about why our investment strategy? Sign up for our newsletter below or schedule a meeting with our team.